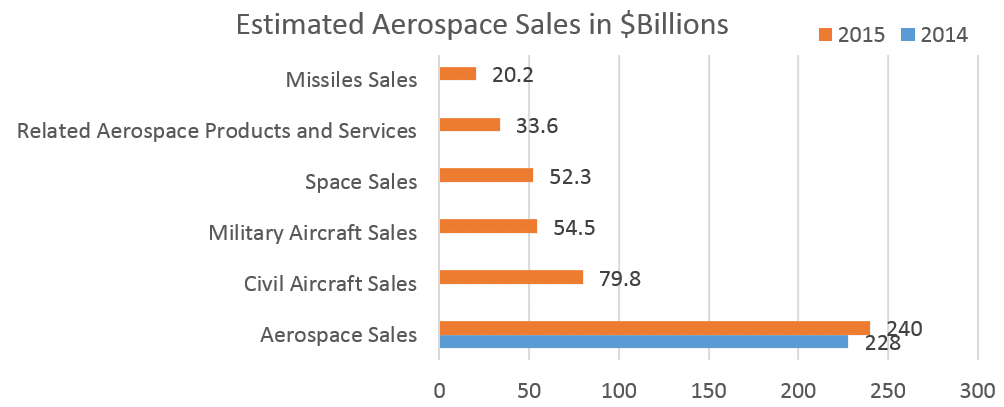

Aerospace industry sales will increase 5.3% in 2015, with civil aircraft sales being the greatest contributor to $79.8B in revenue this year. Related aerospace products and services are expected to net $33.6B and missiles, $20.2B.These and many other insights are from the latest roundup of aerospace forecasts and predictions.

Aerospace industry sales will increase 5.3% in 2015, with civil aircraft sales being the greatest contributor to $79.8B in revenue this year. Related aerospace products and services are expected to net $33.6B and missiles, $20.2B.These and many other insights are from the latest roundup of aerospace forecasts and predictions.

Key take-aways from the roundup include the following:

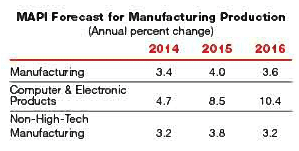

- US manufacturing production will grow 4.0% in 2015, led by housing starts at 29% and aerospace products and parts at 10%. High-tech industrial production, which accounts for just 5% of total production, will grow significantly faster than the rest of manufacturing, Manufacturers’ Alliance for Productivity and Innovation (MAPI) predicts. While non-high-tech production will grow 3.2% in 2014, 3.8% in 2015 and 3.2% in 2016, production of computers and electronic products will rise 4.7% in 2014, 8.5% in 2015 and 10.4% in 2016. Source: Industry Week, MAPI Predicts ‘Broad-based Growth’ for US Manufacturing

- The US Aerospace Industries Association (AIA) estimates that the country’s aerospace industry sales will grow by 5.3% in 2015. Civil aircraft sales will continue to contribute the greatest share, with the AIA forecasting sales in this category will top $79.8B in 2015. Military aircraft sales will contribute $54.5B and space sales $52.3B. Related aerospace products and services are expected to net about $33.6B and missiles $20.2B. AIA is forecasting aerospace industry profits of $25.5B in 2014, up from $22.2B in 2013. Source: Flightglobal, US Aerospace Sales to Grow in 2015

- The global business jet market is predicted to be worth $33.8B by 2020. The global business jet market was valued at $20.9B in 2013 and is expected to reach $33.8B by the end of 2020, attaining a compound annual growth rate (CAGR) of 6.86% in the forecast period. Source: Research and Markets, Global Business Jet Market – Forecasts, Trends & Analysis to 2014 – 2020

- COMAC (China), Irkut and Mitsubishi all planning new jet deliveries entering service in 2015. The Airbus A320neo, the New Engine Option, and the Bombardier C Series, are scheduled to enter service in 2015. Each is powered by the Pratt & Whitney (PW) Geared Turbo Fan (GTF), a 20-year research-and-development gamble that brings PW back into the arena as a major player in single-aisle airplane powerplants. COMAC’s C919 (China), the challenger to the Airbus A320 and Boeing 737 families, is in development and so is the equivalent Irkut MC-21 (Russia), but neither will take to the skies in 2015. The Mitsubishi MRJ90, Japan’s first commercial airliner since the 1960s, is set to enter flight-testing in 2015. Source: CNN, 2015: The Year Ahead in Aviation

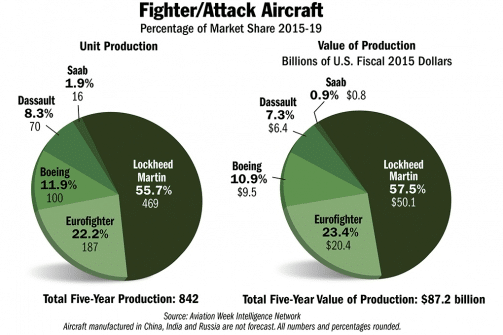

- Lockheed Martin predicted to dominate fighter/attack aircraft production in the 2015-19 time. Accelerating production of the F-35 for U.S. and international customers, plus remaining F-16 deliveries will give Lockheed Martin a dominant share of the combat-aircraft market. After 14 years of development, Lockheed Martin’s F-35 Joint Strike Fighter is expected to become operational with the U.S. Marine Corps in 2015—but aircraft modifications and software testing could push it closer to December rather than the desired July date. Initial operational capability with the U.S. Air Force in August 2016 also is threatened by software development and maintenance training. Source: Aviation Week, 2015 Delivery Forecasts

- The number of consumer drones in use globally is expected to reach one million for the first time in 2015. Deloitte predicts a steady increase in the popularity of non-military drones (also known as unmanned aerial vehicles or UAVs) costing £125 ($188US) or more, with the number in use globally reaching the one million mark for the first time in 2015. Over 300,000 units are expected to be sold in 2015, worth between £125m ($188US) and £250m ($376US). Source: Deloitte, Drones: High-Profile and Niche

- Top technology trends for MRO sector in 2015 include additive manufacturing and wearable technologies. The aerospace and defense sector is already a huge trend setter in terms of adopting additive manufacturing, having contributed more than 10% to the industry’s $2.2B global revenue in 2012. Rolls-Royce and GE Aviation have already announced that they plan to fabricate parts for aircraft engines that are lighter and faster to produce through additive manufacturing. In 2015, it will really show its worth in terms of reducing material costs, decreasing labor content, and increasing availability of parts at point of use, having a dramatic impact on the supply chain. 2015 will see major widespread use of wearables in commercial aviation MRO. In 2014 wearables promised much but delivered little in terms of practicalities. Gartner has predicted that the wearable market will be worth $10B by 2016 so if this respected analyst group is right, things need to get a shift on in 2015. In civil aviation the business need is there and crying out for wearable technology. Witness the example of Japan Airlines with its use of Google Glass in the maintenance process. The glasses are worn by engineers working around the aircraft on the tarmac. Images of the aircraft are sent to maintenance specialists for assessment who then feed any issues they see back to the engineer on the ground. Work is completed promptly, can be assessed in real time and all information is recorded to assess further issues down the line. Source: MRO Network, Top Five Tech Trends in 2015