- 84% of manufacturers are prioritizing integration with their legacy infrastructure and systems.

- 68% of enterprises see mobile as critical/very important to improving internal communication.

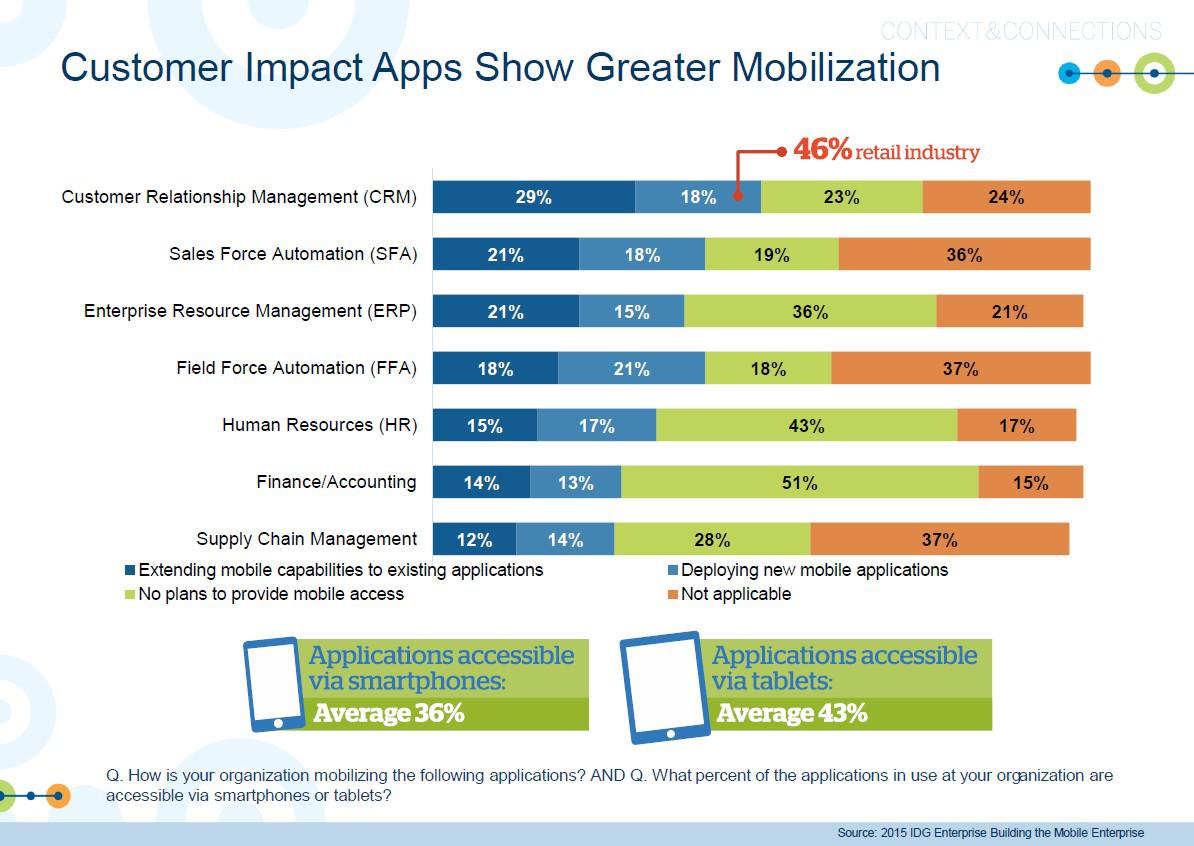

- 46% are augmenting and deploying new mobile Customer Relationship Management (CRM) apps today.

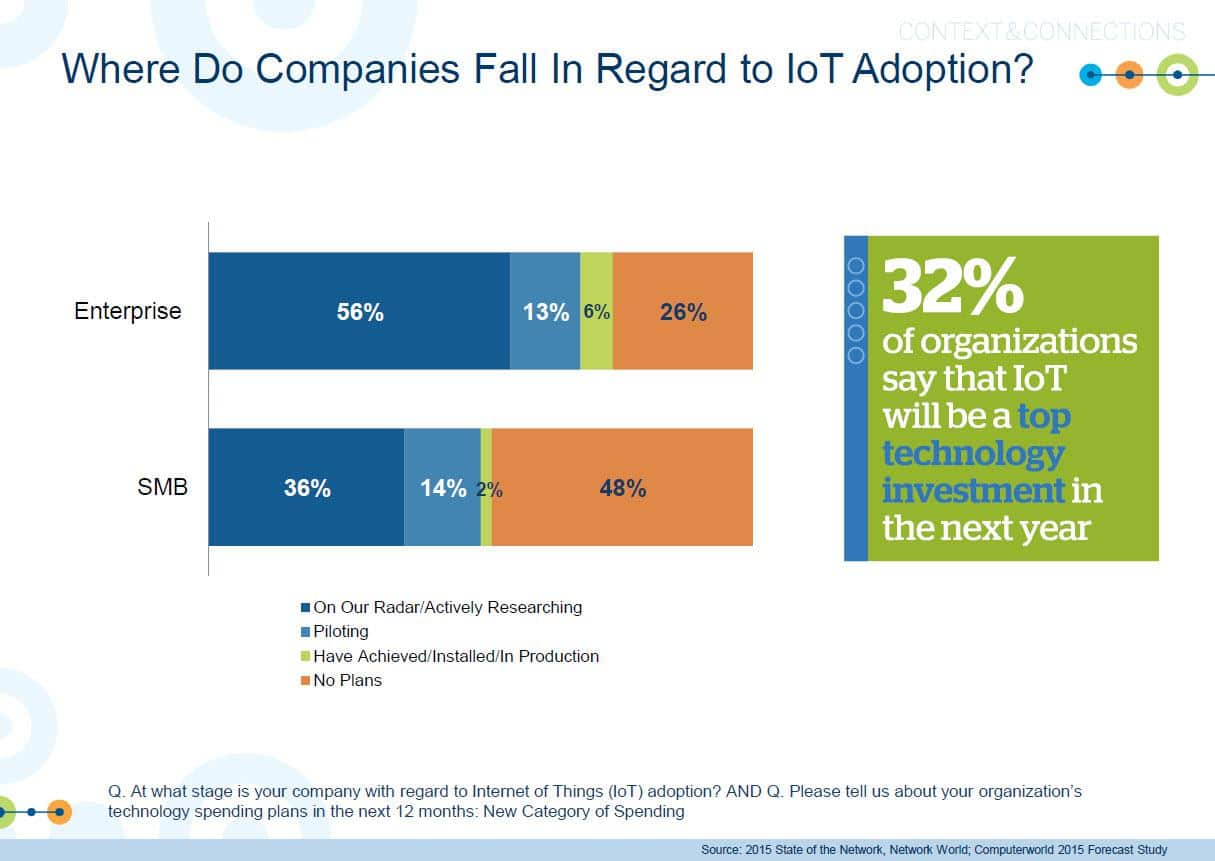

- 32% of enterprises say that Internet of Things (IoT) will be a top technology investment in the next year.

- 38% are using or planning to use cloud-based Mobile Device Management (MDM).

These and other insights are from the 2015 IDG Enterprise Building the Mobile Enterprise Survey published this week. IDG Enterprise interviewed 510 respondents from enterprises with the majority from IT management (39%), executive IT (20%), IT professionals and business management (18%). For a definition of the methodology please see the summary slides here.

Key take-aways from the study include the following:

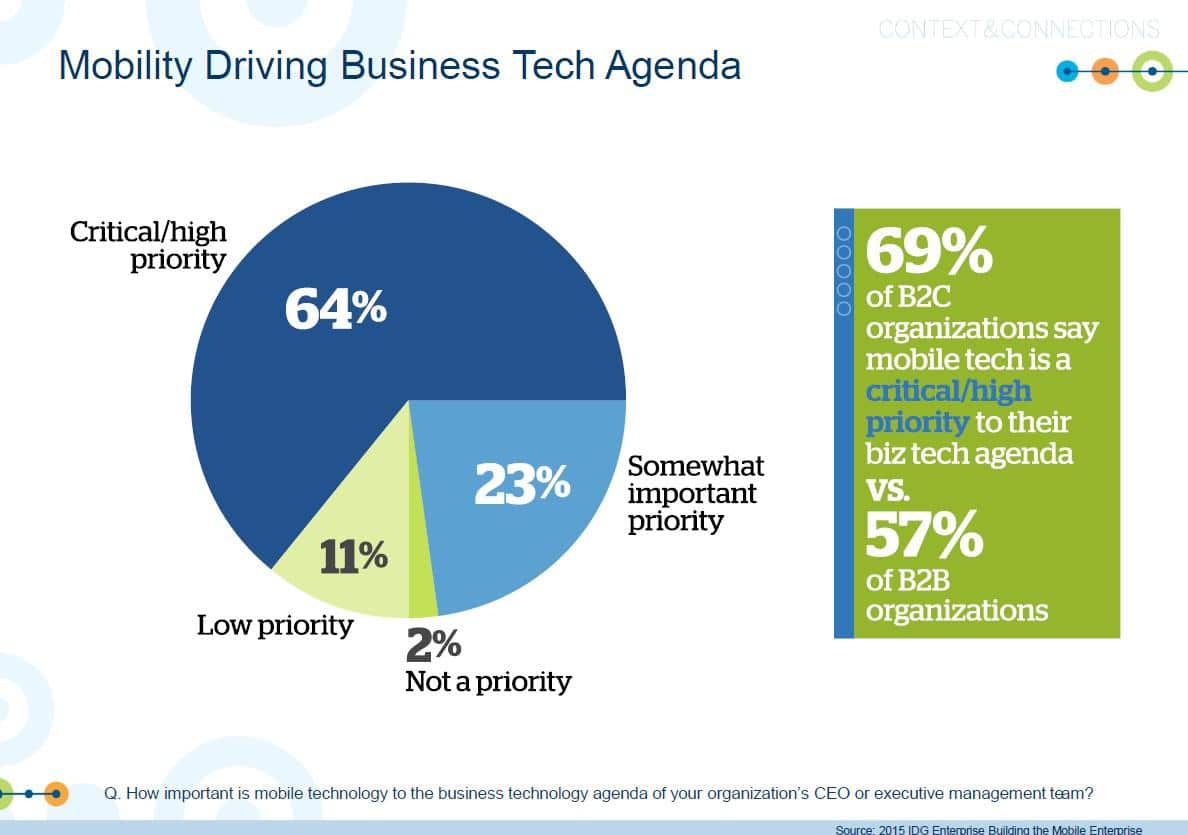

- 64% of enterprises are making mobility a critical or high priority on their technology agendas today. 69% of B2C organizations say mobile technologies to their business/technology agendas versus 57% of B2B organizations. The following graphic compares the levels of priority enterprises are assigning to mobility on their technology agendas today.

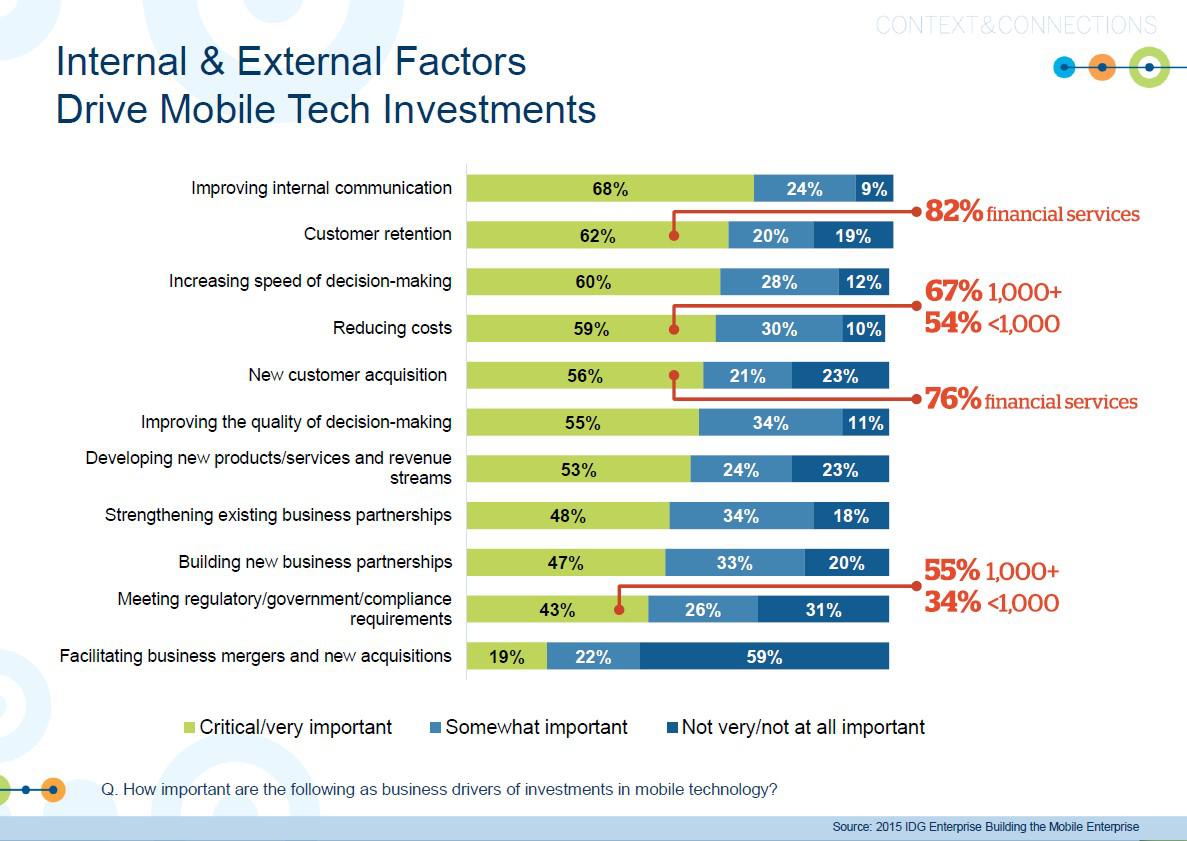

- Improving internal communication (68%), customer retention (62%), and increasing speed of decision-making (60%) are the top three factors driving mobile tech investment today. 82% of financial services firms are relying on mobile-based technologies to sustain and improve customer retention strategies. Enterprises are beginning to see just how critical it is to align selling and services strategies with how prospects and customers prefer to buy, which is increasingly through mobile channels. The following graphic provides an overview of internal and external factors driving mobile tech investments.

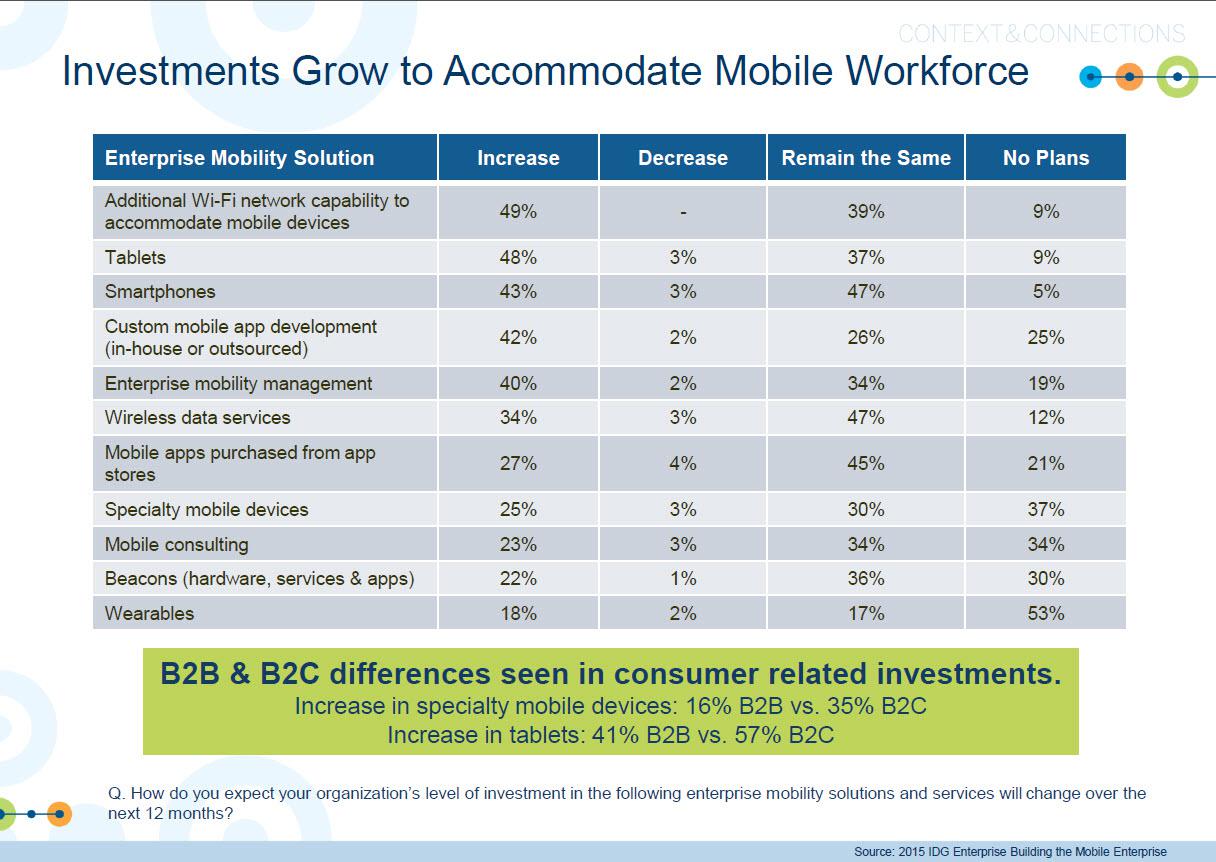

- 49% are planning to add additional Wi-Fi network capability to accommodate mobile devices, 48% are increasing spending on tablets, and 43% on smartphones. 42% are planning to increase spending on custom mobile app development (both in-house and outsourced) and 40% are increasing their investments in enterprise mobility management.

- CRM (46%), Sales Force Automation (SFA) and Field Force Automation (FFA) (both 39%) are the top apps enterprises are investing the most heavily in. CRM leads all app areas, with 29% of enterprises extending mobile capabilities of existing apps, and 18% deploying new mobile apps. 21% of enterprises are extending the mobile capabilities of their SFA apps and 18% are doing the same with their FFA apps. The accelerating adoption of cloud Enterprise Resource Planning (ERP) systems including Acumatica, Plex Systems and others is a factor in 15% of enterprises choosing to deploy new mobile applications.

- 13% of enterprises are piloting IoT projects and 6% are using them in production today. 14% of SMBs surveyed have IoT pilots in progress today and 2% have integrated IoT into their production workflows. The following graphic compares IoT adoption maturity by size of business.

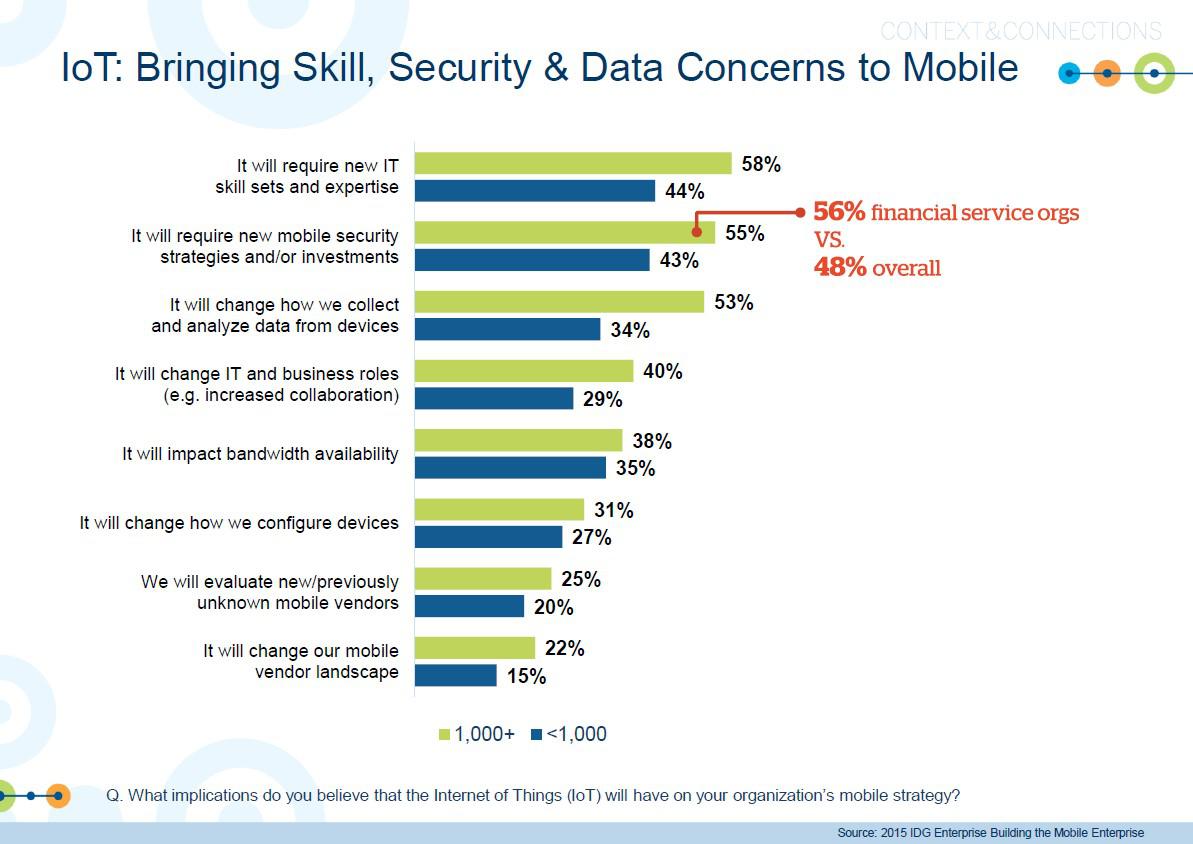

- 48% of all enterprises predict that IoT will require new mobile security strategies and/or investments. 44% of the largest enterprises with over 1,000 employees predict that IoT will require new IT skill sets and expertise as well. The following graphic provides an overview of the eight most significant areas where IoT is predicted to most impact enterprise mobility strategies.

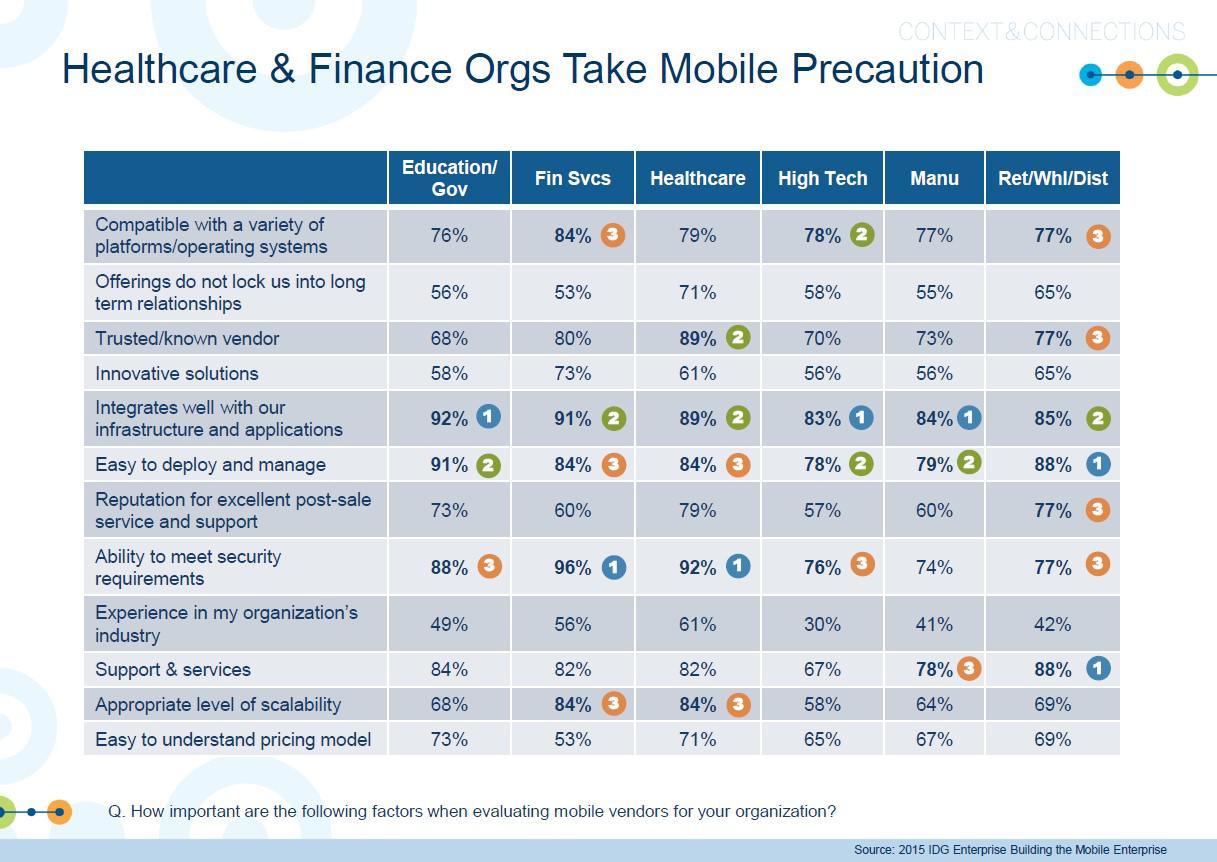

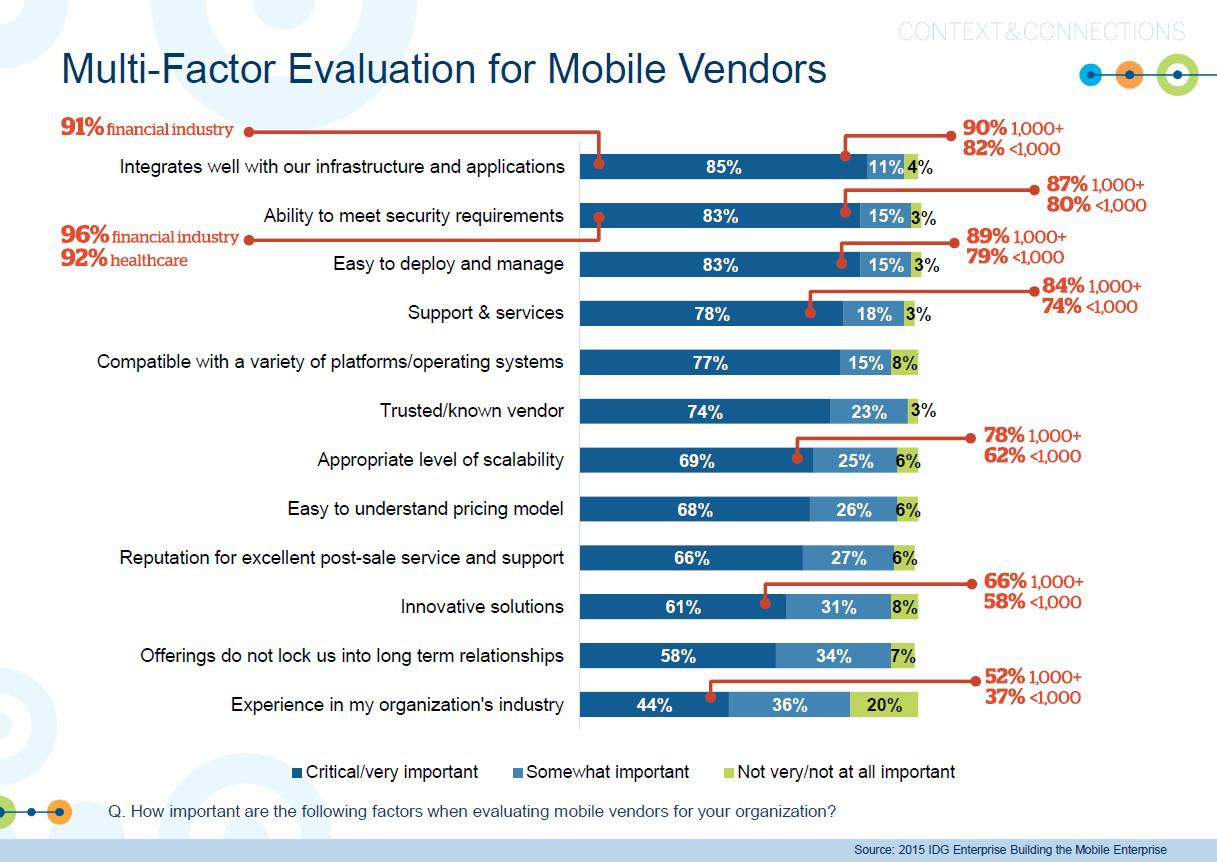

- When evaluating mobile vendors, 90% of enterprises with over 1,000 employees expect potential vendor partners’ products and systems will integrate well with existing infrastructure and applications. In aggregate, 85% of all enterprises expect mobile vendors to provide products and systems that integrate well with existing infrastructure and apps already in use. Additional factors include ability to meet security requirements and ease of deployment and management (both 83%). Support and services is the 3rd most important attribute with a 78% aggregate rating and 84% in enterprises with over 1,000 employees.

- Integration, security and ease of deployment are the top three areas enterprises are using to evaluate mobile vendors. Integration with existing infrastructure and applications is most important in education and government sectors (92%), followed by Financial Services (91%) and Healthcare (89%). Security dominates as an evaluation factor in two of the most regulated industries in the survey, Financial Services (96%) and Healthcare (92%).